*This post was written as a review for Beyond Personal Finance in exchange for compensation. Everything you read in this article is based on my personal experience with using their personal finance curriculum and is 100% truthful. If you’d like to read my full disclosure, you can find it HERE.

The Importance of Teaching Finance

Young children with fresh birthday money burning a hole in their pockets don’t understand the importance of smart spending, saving, and budgeting.

That’s why as children grow older, it’s incredibly important to encourage them not only to spend wisely in the present but also to save for their future.

As someone who grew up in a low-income family and struggled with debt as a young adult, I had to learn some of those important financial life skills the hard way.

Thankfully, because of my past experiences, my teenagers got to learn most of them without experiencing the hardships.

That said, teaching and encouraging wise financial decisions through past personal experiences is only one of the ways a parent can raise financially smart children.

The second? A solid financial curriculum.

3 Reasons to Use a Finance Curriculum

While math, language arts, history, and science are what many parents and educators consider the core learning subjects of elementary, middle, and high school.

Those electives and extras are sometimes just as essential, you guys.

That said, there are 3 key reasons you should be teaching finance as a part of your homeschool curriculum lineup!

Encourages Wise Spending & Saving

While you truly can start encouraging good spending and saving habits at any age, utilizing a strong financial curriculum during the tween and teen years can help set a whole new tone for your child’s financial future.

In today’s world, young kiddos are used to instant gratification, and because their parents supply all their needs they have no real knowledge of how much life actually costs.

Plus, most children who are about to embrace their teenage years have absolutely no idea how to practice smart saving and spending.

This is why utilizing a finance curriculum at the start of middle school is incredibly important.

My 11-year-old only just recently started to pick up on the true cost of everyday living when we pulled her aside for a financial heart-to-heart.

She desperately wanted to experience some of the things, such as smartphones, smartwatches, and electric scooters, that many of her friends had.

After some serious discussion, she began to realize that making money decisions can be tough and purchasing all your wants can come at a high cost.

While our minimalistic approach to spending was a great foundation for teaching her about money, having a solid curriculum that focused on the spending vs saving process was a helpful addition to our summer homeschool routine!

All that said, utilizing a financial curriculum in your homeschool is a great way to reinforce what children should already be learning at home.

Builds Important Life Skills

While learning to spend wisely and build up savings is important, there are other important life skills children can learn through using a finance curriculum!

Like how to make a budget for example.

Many of the skills you will find in this financial curriculum simply aren’t taught in public schools, you guys!

Kids spend their whole school career memorizing facts and learning how to take tests but will graduate high school lacking the simple financial skills they will need for everyday life!

For example, my older boys have friends who lack the ability to perform simple math skills such as giving cash back, and larger financial skills such as building a savings account.

When children don’t learn these things before stepping out into the world they either never learn them and find themselves stuck in a never-ending paycheck-to-paycheck life or they learn them through the harsh reality of being broke.

In the end, utilizing a finance curriculum in your homeschool is a great way to teach your kiddos important financial skills without encountering harsh life experiences.

Prepares Them for the Future

This is the one that takes the cake!

If you only need one reason to teach finance to your tween students, this would be it, you guys!

Rarely does any brick-and-mortar school system prepare children for life after lessons.

So many kids enter into adult life with unrealistic expectations about money and get blindsided when everything turns upside down.

My boys are currently walking life in this price-inflated world and have already had to make some tough decisions when it comes to money.

Currently, they are working on building their savings, while their friends who work the exact same jobs they do are struggling with the paycheck-to-paycheck life with no end in sight.

Sadly, this seems to be the harsh reality for most teenagers and young adults today.

While I’m thankful they are doing much better than their peers, I do know they could have benefited even more if we had chosen to utilize a financial curriculum during their tween years.

Being prepared for the future, from paying bills and buying a car to paying for college or buying a home, utilizing a solid financial curriculum can help teens be more equipped to handle future financial burdens and decisions.

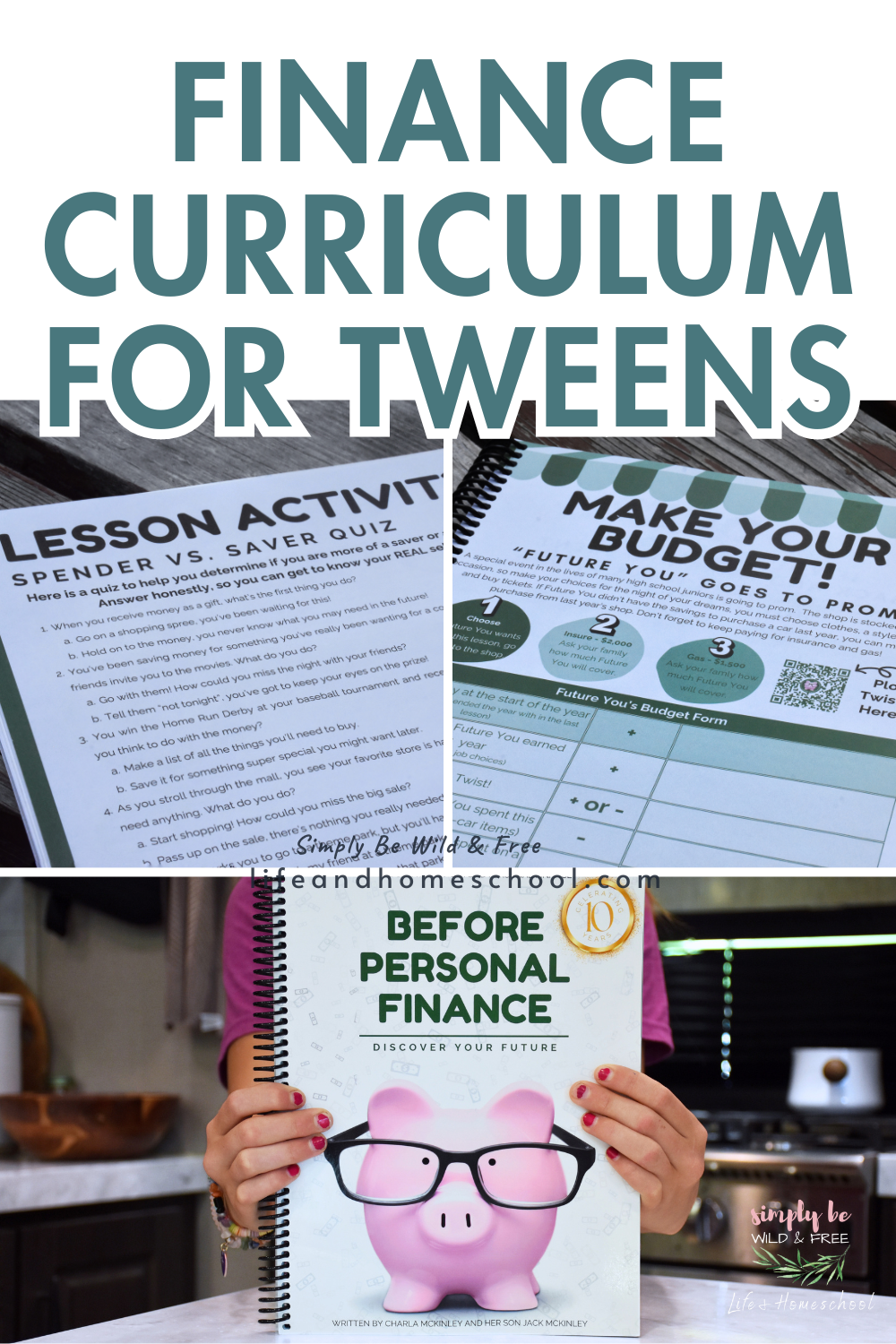

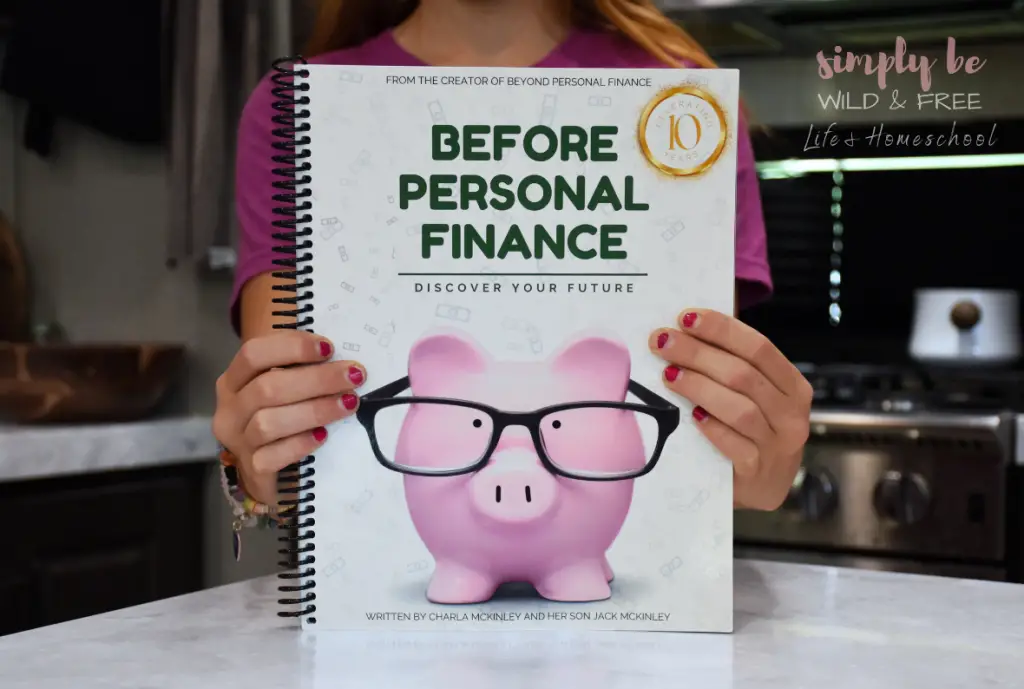

Before Personal Finance Curriculum

I was super excited to add this one to our summer homeschool lineup, you guys!

Before Personal Finance is designed to be used with tween kiddos (ages 8-12).

This finance curriculum has 10 lessons which are stated to include 30 minutes of teaching time, 45 minutes – 1 hour of activity time, 30-45 minutes of budgeting, and 15 minutes of quiz time.

That said, in our personal experience, we were able to knock out an entire lesson in under an hour easy.

Finance Curriculum Breakdown

This spiral-bound curriculum is simple, fun, and to the point!

You can find my full breakdown of each section below!

Teachers Corner + Future You

First up in this curriculum is Teacher’s Corner.

This section is a dedicated page for the parent/teacher and can be found at the beginning of each lesson and includes a QR code with lesson resources, a brief overview of the upcoming lesson, and additional instructions if needed.

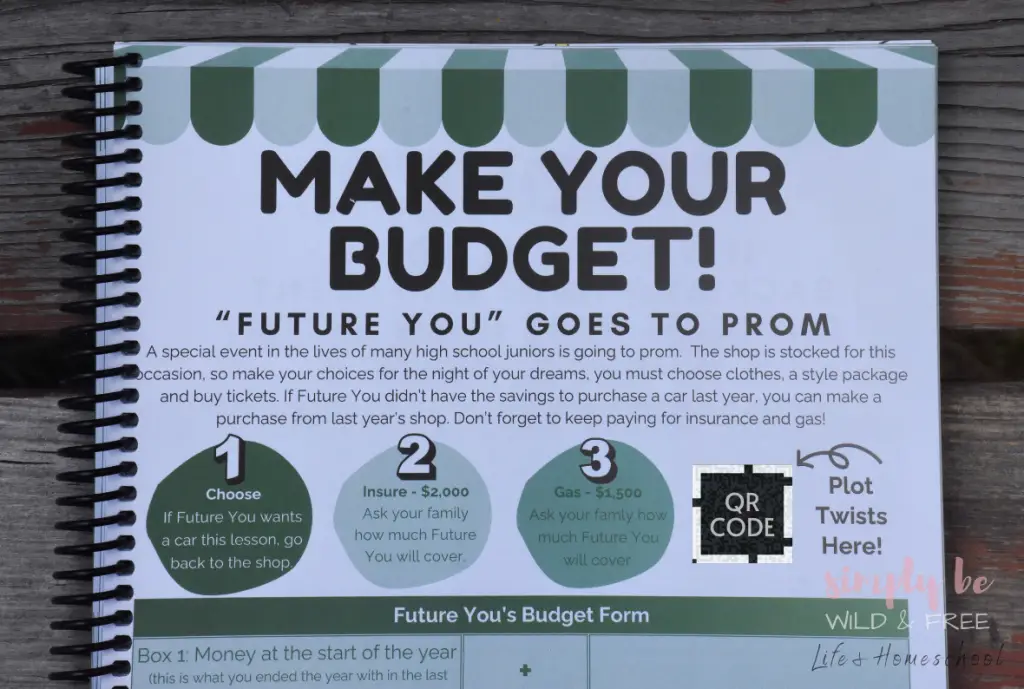

The next unique section of this finance curriculum is Future You.

This one sets the tone for the entire lesson. Future You is filled with future scenarios tweens will likely go through in the coming years — such as starting high school, getting a job, buying a car, and going to prom.

My daughter absolutely loves this part!

At age 11, she is still very much a kid and enjoys the imaginative fun of pretending to be older.

This truly is one of the things that sets this finance curriculum apart, you guys!

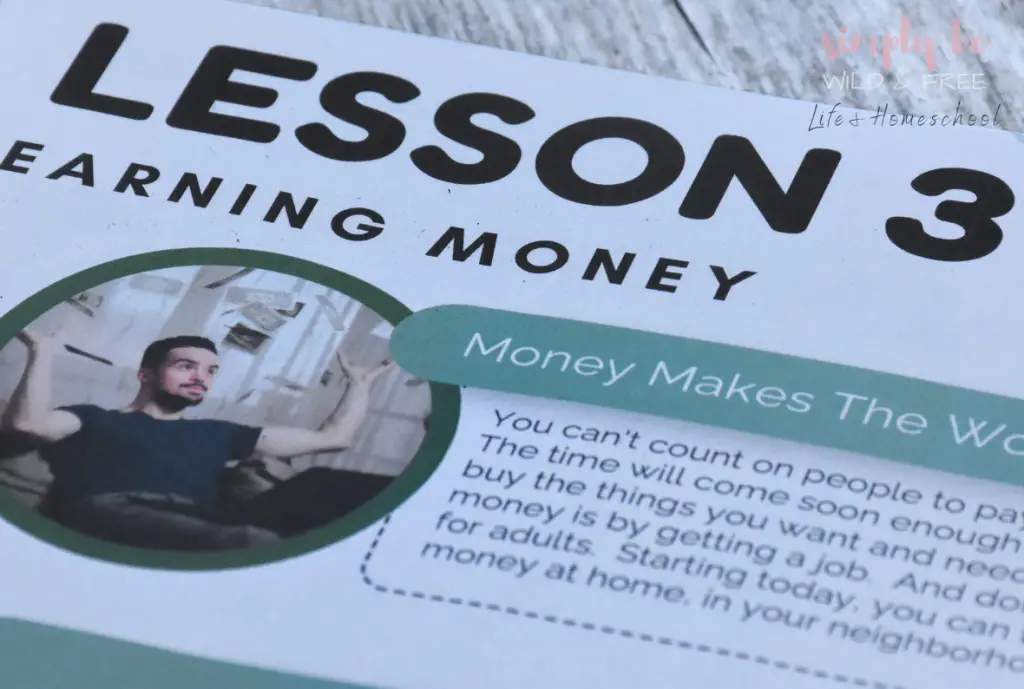

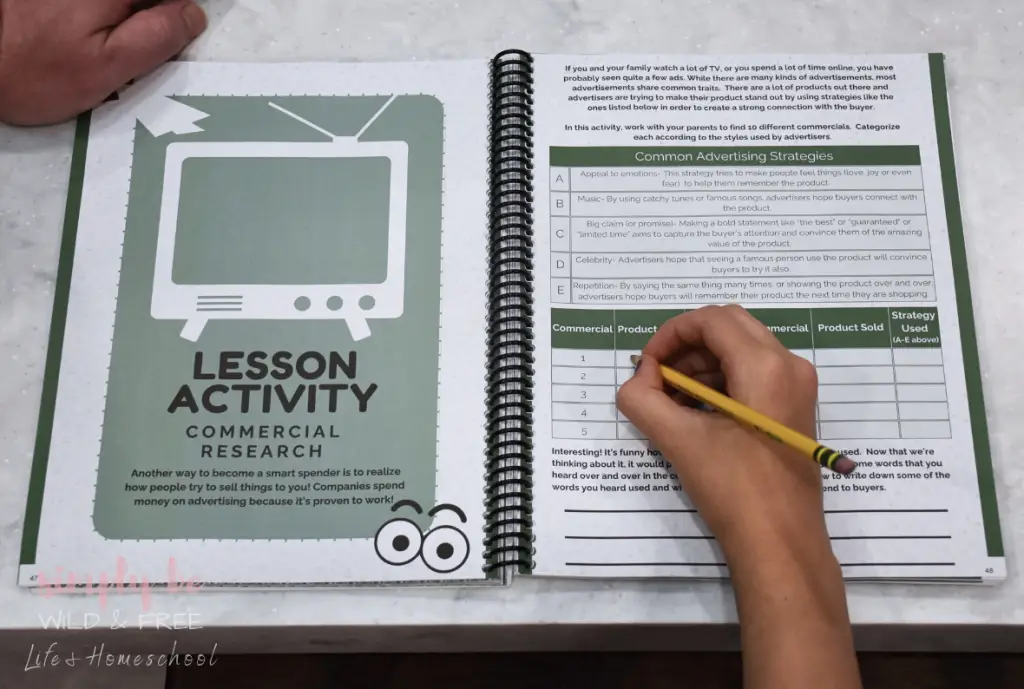

Lesson + Activities

Lessons are simple and to the point. Each lesson covers a particular area about money and includes multiple talking points (or reading points if a child is working through this alone).

My husband (the math teacher in our home) chose to read this portion aloud to our daughter to open things up for discussion if needed.

This section is pretty quick to work through and is very informative.

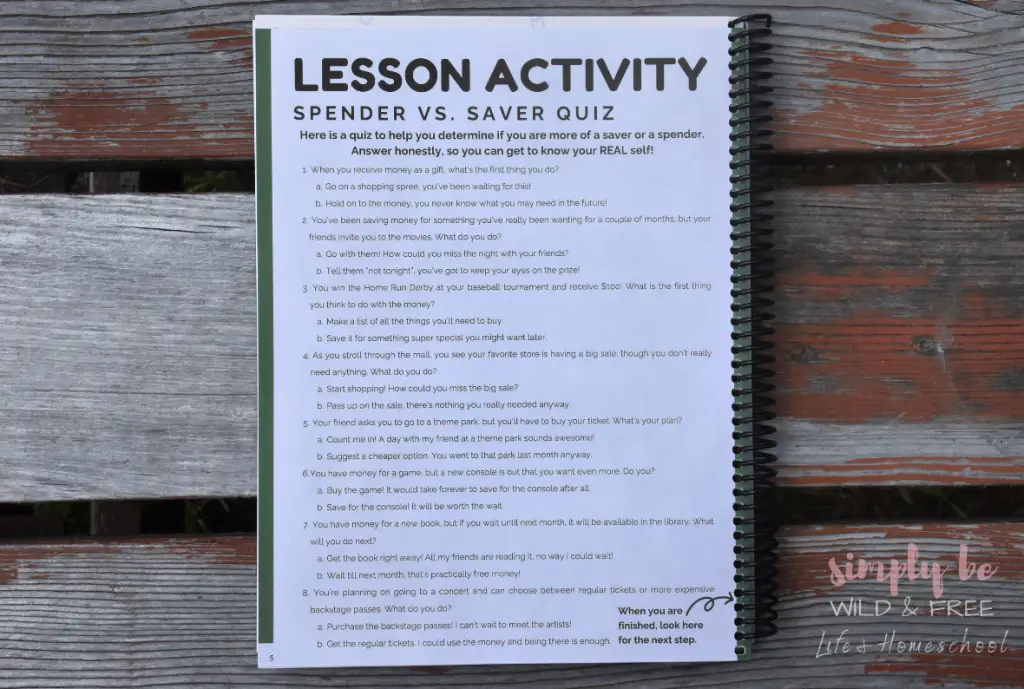

The lesson activities are unique to each lesson theme and the time needed can vary. They are a fun way to extend the learning experience and encourage children to make healthy financial decisions as they grow up.

Kiddos get to participate in important brain-building exercises that will inspire them to view money differently.

Plus, each lesson has a simple puzzle to complete — such as word searches or crosswords.

Puzzles aren’t my daughter’s jam so I allowed her to skip a few of these. The main lesson activities, however, she absolutely loved!

Store + Budgets

The Future You scenarios combined with the store and budget sections were hands down my daughter’s favorite part of this financial curriculum!

Kiddos have to make some tough decisions in this section too, you guys!

My daughter overspent at the store on her first go-around and had to redo her budget completely.

Thankfully there is a budget do-over page included in each lesson.

While some of the store and budget activities aren’t always practical for real life, they are a super fun way to teach important budgeting concepts in an age-appropriate manner.

Store shopping money is gifted or earned throughout the book and is used in during the budgeting process.

Stores are filled with multiple different options and past stores can be revisited throughout the course of the book.

Budgets include plot twist QR codes making the art of budgeting mirror real life with unexpected expenses and monetary gifts.

These are so much fun, you guys!

My daughter had a plot twist that cost her $80 on her first budget.

Then, she decided to work on her do-over budget.

We prompted her to start from scratch and get a new plot twist which totally worked out in her favor.

Her new plot twist landed her with $200 extra dollars to spend and she was able to purchase everything she wanted from the store.

The budgeting sections also include a scratch pad for calculating purposes.

Lesson Extras + Quizes

Finally, we have the lesson extras & quizzes.

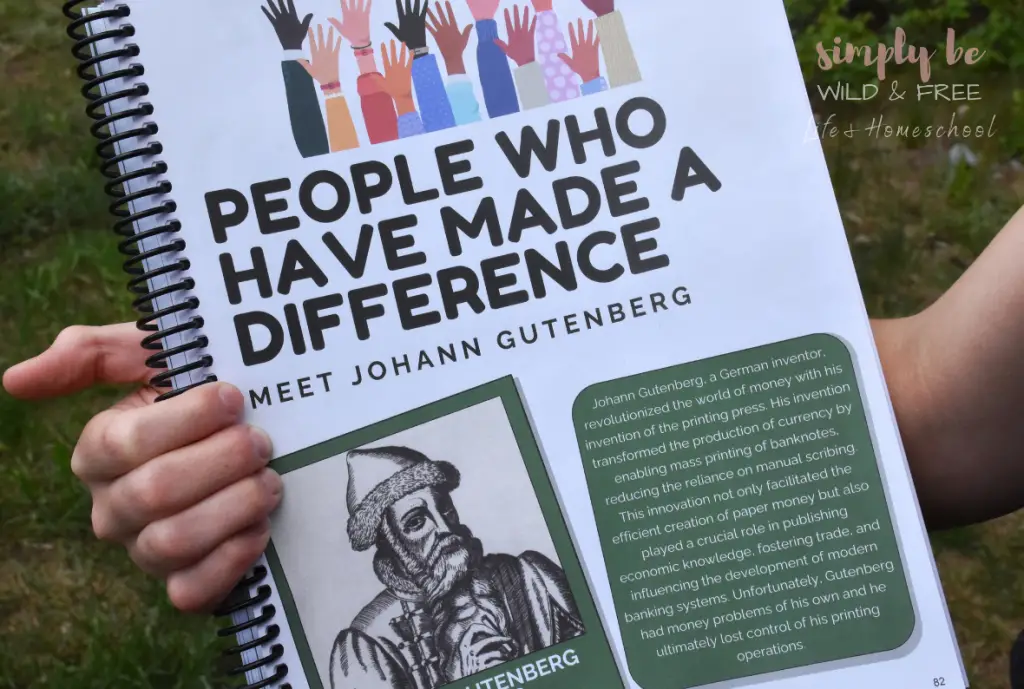

The People Who Made a Difference section of each lesson is quite possibly my favorite part.

It’s like a mini history lesson on people who played key roles in currency making and other influential figures in finance.

These lesson extras also include a 10-question comprehensive quiz after each lesson and a section for reflecting on the future you choices made throughout the lesson.

Lastly, this financial curriculum includes a grade book page.

While this part isn’t important to me, I know many homeschoolers prefer to track grades, and having this page available will be a huge plus!

There are also some important KEY terms found in the back of the book as a quick reference for teachers and students.

Why We Loved This Finance Curriculum

I thoroughly enjoyed the flexibility of this curriculum and it was incredibly easy to fit into our summer homeschool schedule

I truly feel like it has an open-and-go approach making it an easy go-to option for most homeschoolers!

The lesson structure was simple, and informative, and could be done with or without parental supervision.

While my 11-year-old is typically a self-paced learner and I believe she could have done this completely on her own, we chose to work through this collaboratively to encourage more in-depth conversation instead.

That said, self-leaners can totally tackle this on their own!

Get Your Personal Finance Curriculum

Before Personal Finance gives tweens the opportunity to see how financial choices could impact their life before stepping out into the world.

Making tough choices with pretend money through hypothetical situations will prepare them for a financially sound future.

Get your hands on this awesome curriculum and encourage your kiddos to start making wise financial decisions today!

View this post on Instagram